The Internal Rate of Return is the rate of interest received for the investment made. In addition, it falls under the category of financial functions. It is one of the built-in functions available in Microsoft Excel. read more in Excel stands for Internal Rate of Return.

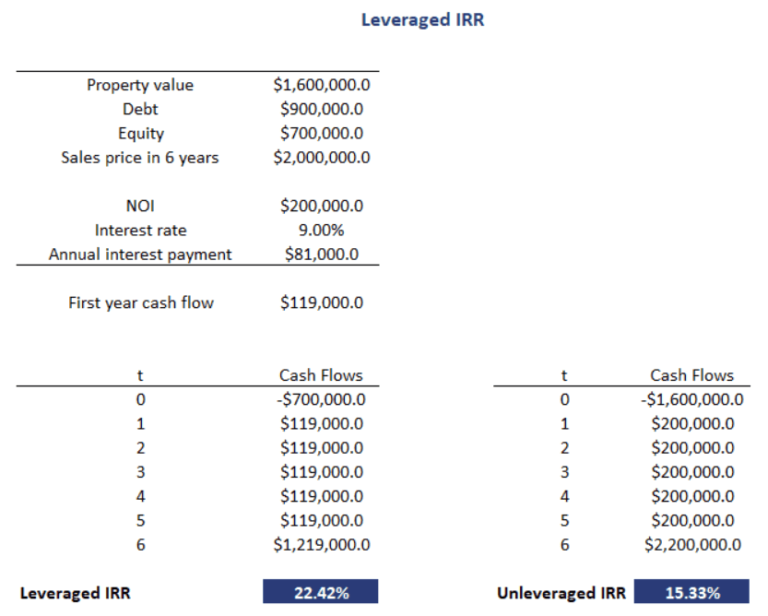

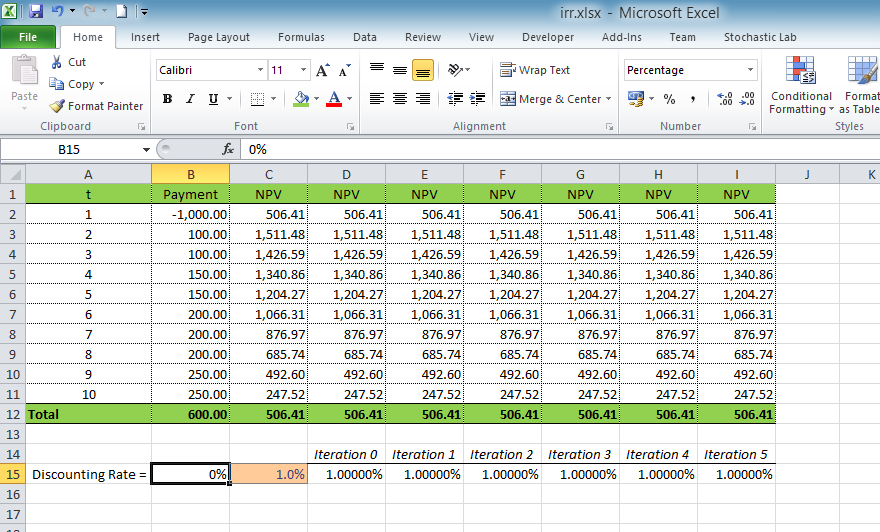

It compares and selects the best project, wherein a project with an IRR over and above the minimum acceptable return (hurdle rate) is selected. IRR IRR Internal rate of return (IRR) is the discount rate that sets the net present value of all future cash flow from a project to zero. It is equivalent to money invested at 15% for 10 years. As a result, the IRR comes out to be 15%. We can use this data to calculate the IRR of this investment which is the rate of return you may get on your investment of $100. This function takes a range of values as an input for which we need to calculate the internal rate of return and a guess value as the second input.įor example, suppose your company made an initial investment of $50,000 and expects to generate $10,000 yearly for the next 10 years. IRR is an inbuilt function in Excel used to calculate the same. IRR, or Internal Rate of Return, is used to calculate the internal profit for some investment in financials.

0 kommentar(er)

0 kommentar(er)